STRUCTURE

Structure is a decentralized blockchain-based platform for structured financial products

Log inUnderstanding Structured Financial Products

Structured financial products offer user more varieties for different risk appetite without requiring much expertise in financial product design

Structured financial products are invented in order to offer a simplified user experience for the retail investors

By packaging interest rate products together with derivatives, there is more variety of products that retail users could choose from based on their preference

Basic Financial Instrument

Derivatives

Structured Product

What is Structure?

Built on Ethereum and BSC with Layer 2 Scaling

Structure chose ETH and BSC for compatibility with other DeFi protocols. It also chose layer 2 protocols to provide better user experience for trading.

Palette for Users to Create Structured Products

The beauty of DeFi applications as compared to traditional finance is that all the protocols are permissionless and open source. Structure will support major DeFi protocols for user created applications.

More Product Options for DeFi Users

Structure offers structured products like double no-touch options and straddle options to give DeFi traders more options.

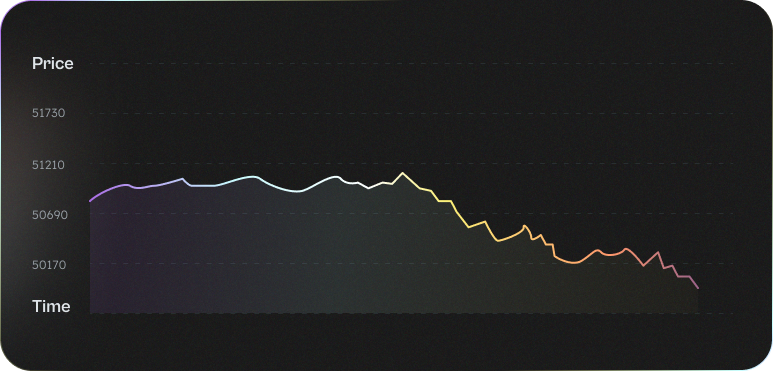

In Structure, the double no touch options support major cryptocurrencies. Users can purchase the DNT token, and that given the price touched the barrier, the token price will goes to zero and otherwise users could profit from the DNT. The validity of the DNT is only for a limited period of time and that when that time period ends, the DNT token price will be reset and tat a new cycle begins.

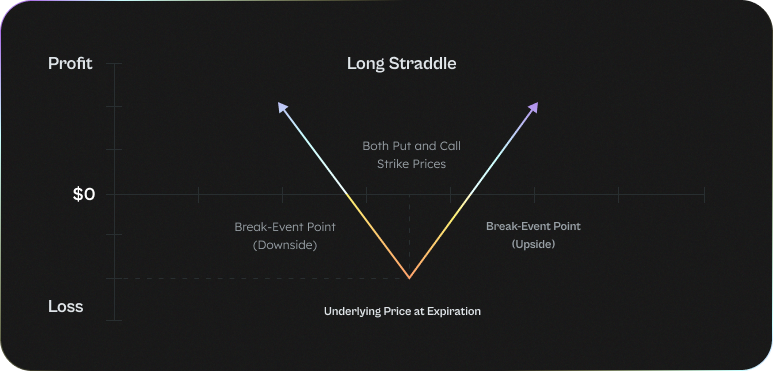

Straddle is a neutral options strategy that involves simultaneously buying both a put option and a call option for the underlying security with the same strike price and the same expiration date.

A trader will profit from a long straddle when the price of the security rises or falls from the strike price by an amount more than the total cost of the premium paid.

Oracle

Oracle

Dezentralized Oracle

Initially, Structure will integrate with decentralized oracle service providers to get external price data for the structured products.

Offchain Workers

As Substrate ecosystem is more mature, Structure will use offchain workers module for obtaining external data.

Other Protocols

Structure will also support other DeFi protocols and receive price data directly from thode platforms such as Uniswap.

Platform Currency

SBS is the default currency in the Structure platforms. Users could use SBS for transaction fees and also for purchasing option products. The transaction fees will be collected and contributed to the reserve, and further on allocated through decentralized governance.

User Incentives

To encourage users to deposit assets and incentivize a positive feedback loop, there will be token incentives given in SBS. it is important for the platform to have initial liquidity to enable the option products to have more accurate pricing and better profitability.

Governance

SBS implements decentralized governance for the platform development. The token holders collectively decide on the platform governance. In terms of fee ratio setup and different protocol support.

Loram ipsum dolor si amet Loram ipsum dolor si amet Loram ipsum dolor si amet Loram ipsum dolor si amet

Loram ipsum dolor si amet Loram ipsum dolor si amet Loram ipsum dolor si amet Loram ipsum dolor si amet

Serge Levin

Serge has nearly 20 years of experience in managing structured product issuance, trading and sales. Previously, he was a quantitative trader at Point72 and managed structured product portfolios at Nomura, Citi Bank and Morgan Stanley. He holds a PhD in Biophysics from the Albert Einstein College of Medicine.

Kent Osband

Kent has 30 years of experience in monitoring strategic risks for major investment firms, international financial institutions and think tanks, including Fortress Investment Group, Goldman Sachs and the International Monetary Fund. He graduated magna cum laude from Harvard, holds a PhD in economics from UC Berkeley, and is the author of three books on financial portfolio risk.

Evelina Lavrova

Evelina has about 15 years experience in Business Development and Marketing. Prior to joining Structure, Evelina was a Global Marketing and PR of Waves and Gett. Evelina was featured in Forbes and Thrive Global. In 2017, she was nominated in Top 10 Women In Crypto by Core Magazine.